Industry association SEMI said semiconductor manufacturers will spend $400 billion on computer chip-making equipment in 2025-2027.

Spending on 300mm fab equipment is being driven by regionalization of semiconductor fabs and the increasing demand for artificial intelligence (AI) chips used in data centers and edge devices, SEMI report indicated.

Key equipment vendors include ASML, Applied Materials, KLA and Lam Research, and Tokyo Electron.

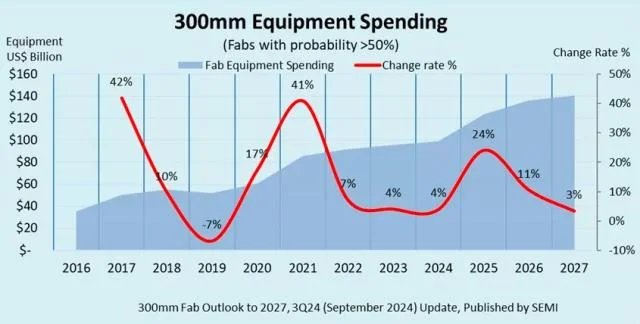

In 2024, spending on 300mm fab equipment is projected to grow by 4 percent to $99.3 billion.

In 2025, spending on 300mm fab equipment is projected to increase by 24 percent to $123.2 billion.

In 2026, spending on 300mm fab equipment is forecast to achieve 11 percent growth to $136.2 billion.

In 2027, spending on 300mm fab equipment is projected to grow by 3 percent to $140.8 billion.

“The world’s need for chips is boosting spending on equipment for both leading-edge technologies addressing AI applications and mature technologies driven by automotive and IoT applications,” Ajit Manocha, SEMI President and CEO, said.

China is projected to invest over $100 billion on 300mm equipment in the next three years driven by its national self-sufficiency policies. China’s spending on 300mm equipment is anticipated to decrease from a peak of $45 billion in 2024 to $31 billion by 2027.

South Korea, home to memory chip makers Samsung and SK Hynix, is estimated to invest $81 billion on 300mm equipment in three years to enhance its dominance in memory segments including DRAM, high-bandwidth memory (HBM), and 3D NAND Flash.

Taiwan, home to top contract chipmaker TSMC, is forecast to spend $75 billion on 300mm equipment over the next three years as the region’s chipmakers build some new fabs overseas.

Americas is projected to invest $63 billion on 300mm equipment from 2025 to 2027.

Japan, Europe & Mideast, and SE Asia are expected to spend $32 billion, $27 billion, and $13 billion, respectively, on 300mm equipment.

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'