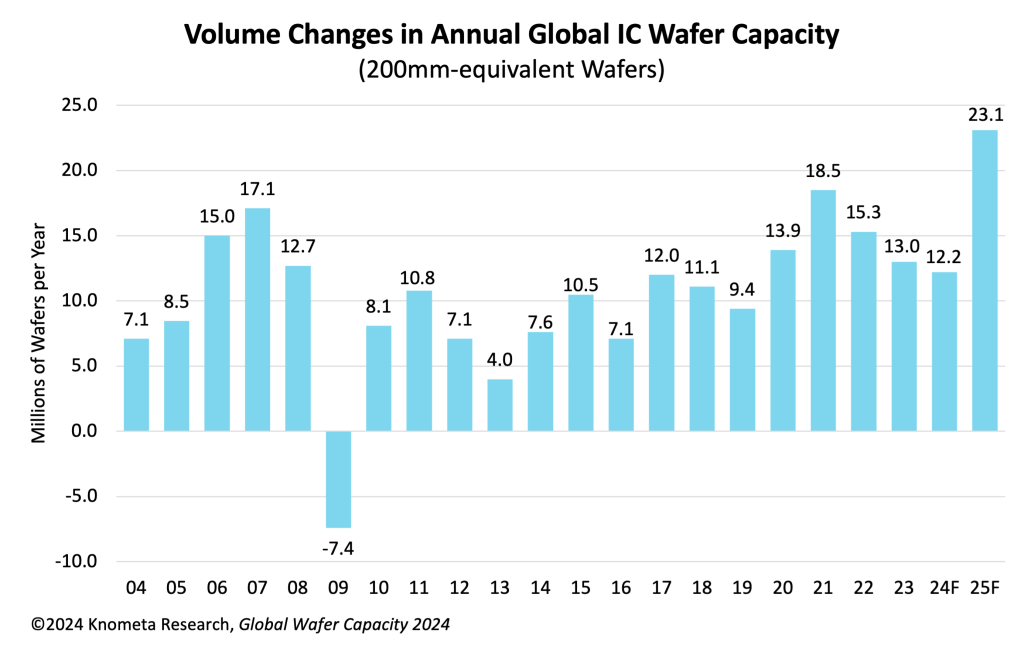

The expansion of fab capacity in 2024 is expected to be relatively low at 4% as manufacturers let capacity utilization rates recover from the low levels experienced in 2023, according to the Global Wafer Capacity 2024 report from Knometa Research

Construction started in 2022 on many fabs originally scheduled to begin operations in 2024, but the market downturn that began that year caused the start date for some fabs to be pushed out to 2025, joining many other fabs already scheduled to open during that year.

The result is predicted to be a record volume of capacity brought online in 2025.

The report shows that 23.1 million 200mm-equivalent wafers per year of capacity is projected to be put into production in 2025, surpassing the previous high of 18.5 million wafers in 2021.

When expressed in 300mm wafer equivalents, there will be 10.3 million wafers per year of capacity brought online in 2025. In terms of growth rate, this is an 8% increase compared to the 2024 capacity level.

Seventeen new fab lines for IC production are scheduled to begin operations in 2025. These include the following:

HH Grace – Wuxi, China – 300mm wafers for foundry services

Intel – New Albany, Ohio, USA – 300mm wafers for adv. logic and foundry

JS Foundry – Ojiya, Niigata, Japan – 200mm wafers for ICs (and discretes)

Kioxia – Kitakami, Iwate, Japan – 300mm wafers for 3D NAND

Micron – Boise, Idaho, USA – 300mm wafers for DRAM

Pengxin Micro – Shenzhen, China – 300mm wafers for foundry

Samsung – Pyeongtaek, S. Korea (P4 fab) – 300mm wafers for 3D NAND and DRAM

SK Hynix – Dalian, China (Fab 68 expansion) – 300mm wafers for 3D NAND

SMIC – Shanghai, China (SN2 fab) – 300mm wafers for foundry

TI – Sherman, Texas, USA – 300mm wafers for analog and mixed-signal

TSMC – Tainan, Taiwan (Fab 18, Phase 8) – 300mm wafers for foundry

UMC – Singapore (Fab 12i, Phase 3) – 300mm wafers for foundry

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'