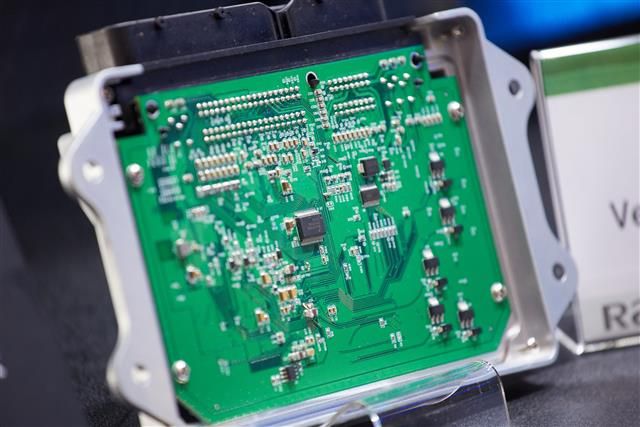

According to the report from DIGITIMES on July 27, the supply of automotive and industrial chips remains tight, while consumer chip inventories continue piling up throughout the supply chain.

Industry sources said consumer IC inventories held by distributors and downstream device vendors have reached alarming levels; nearly every segment of the consumer IC industry is in a state of overstock.

In the best-case scenario, it may take half a year for consumer IC suppliers to complete their inventory correction, according to the sources. Thus, the outlook for consumer electronics demand in the second half of 2022 is generally pessimistic.

TSMC has previously warned that customers may adjust inventory through the first half of 2023.

TSMC CEO CC Wei said in the latest earnings conference call that with smartphone, PC and consumer end market momentum slowing down, related industry supply chains will be involved in inventory correction throughout the second half of 2022.

Additionally, the outlook for automotive, industrial and other non-consumer IC demand remains promising, according to industry sources. IDMs, such as NXP Semiconductors, continue to see their automotive and industrial chip supply fall short of demand.

Source from ijiwei

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'