According to Bloomberg, ASML's new-generation EUV consumes about 1 megawatt of electricity each. Samsung, TSMC and other chip manufacturing majors consume huge amounts of energy; TSMC is highly dependent on fossil fuels and will consume an estimated 12.5% of Taiwan Province of China's energy in 2025.

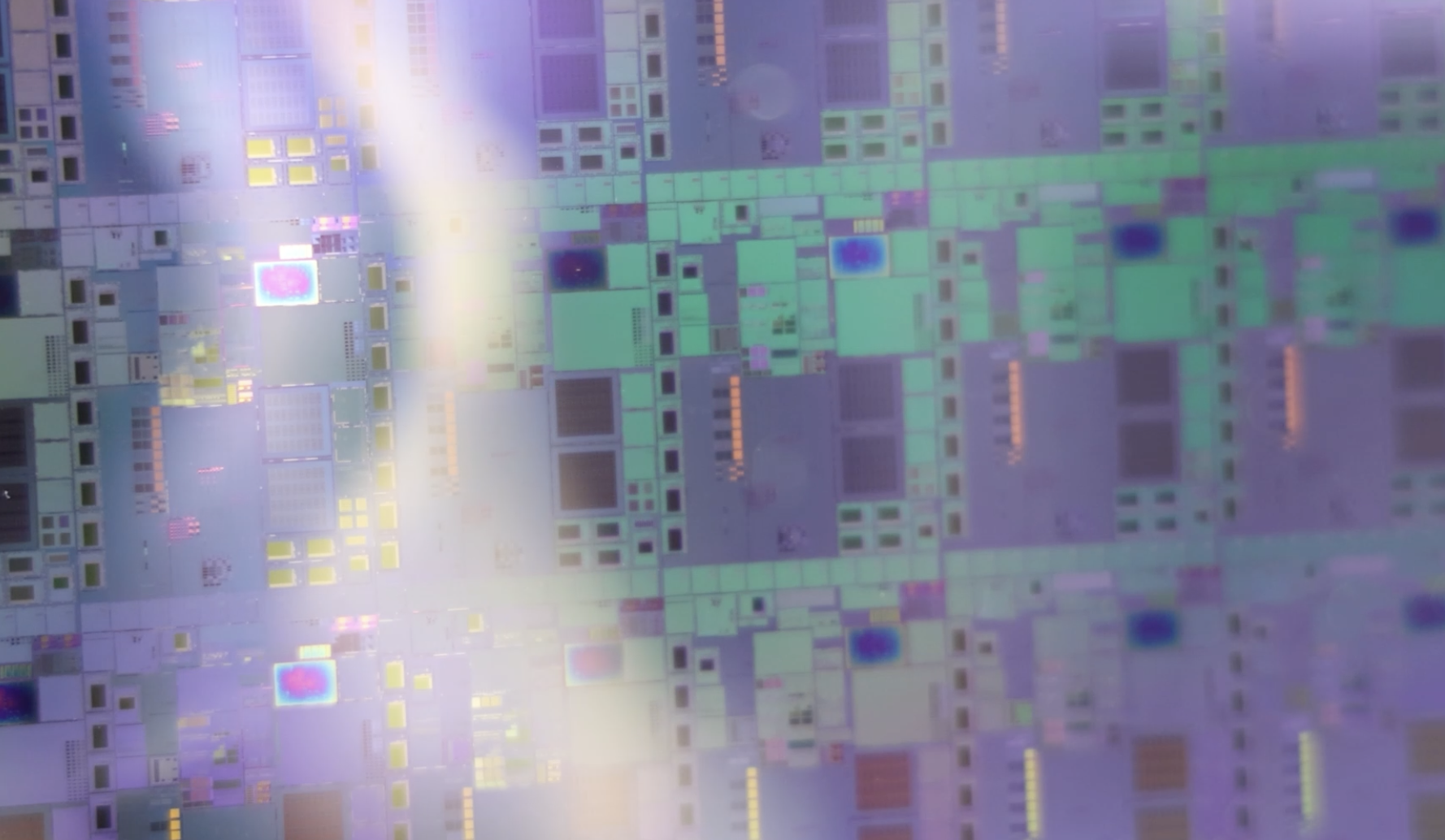

ASML, the world's only EUV company, has a new generation of EUV lithography machines costing up to $150 million, containing 100,000 components and up to 2 km of wiring. euv lithography embodies the manufacturing process of more advanced chips is becoming complex and energy intensive. ASML's current rated power consumption per EUV is about 1 megawatt, about 10 times that of previous generations of equipment, but since there is no alternatives to make state-of-the-art semiconductors, the chip industry could become a major stumbling block to reducing global carbon emissions.

TSMC has the most EUV lithography machines in the industry, and the company currently has more than 80 EUVs, with a new generation of equipment still being installed. TSMC alone is expected to account for 12.5% of the overall energy consumption of all of Taiwan Province of China by 2025, up from 6% by 2020.

In addition to TSMC, another major storage chip maker Micron Technology plans to use at least one EUV lithography machine at its plant in Taiwan, China. According to Bloomberg analyst Charles Shum, within three years, a quarter of the chip manufacturing in China's Taiwan foundries will use EUV lithography.

For the chip manufacturing energy consumption problems, environmental groups Greenpeace (Greenpeace) climate energy project director Zheng Chu Xin has said that the lack of electricity is bound to happen, other industries will be implicated by it. Belgium Microelectronics Research Center (Imec) Lars-AkeRagnarsson pointed out that in the use of high energy-consuming equipment chip factory, renewable energy becomes urgent and necessary.

Bloomberg suggested that the impact of chip manufacturing on the environment will depend on the source of electricity consumption. TSMC is said to be highly dependent on fossil fuels. in 2016, the Chinese authorities in Taiwan set a target of achieving 20% of its electricity from renewable sources by 2025, but its latest energy assessment released in July showed that only 6% of its electricity would come from renewable sources by the end of 2021.

South Korean chip manufacturing giant Samsung is facing similar energy consumption problems. Samsung has six semiconductor manufacturing sites in South Korea, accounting for 3 percent of its power consumption in 2021. To compete with TSMC for more customer orders, Samsung is expanding its use of EUVs. The company has not publicly stated the number of machines it owns. in early June, JayLee, head of Samsung Group, traveled to the Netherlands to strike a new deal with ASML.

source:aijiwei

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'