Spain will focus on producing less advanced semiconductors used in domestic industry after its ambition to make cutting-edge microchips has so far failed to attract investment, according to people familiar with the government's plans, Bloomberg reported.

The Spanish prime minister is focusing Spain's 12.3 billion euro ($12.9 billion) plan on mid-range semiconductors after losing bids for production facilities to Germany and the United States this year, said the person familiar with the matter, who requested anonymity because the strategy was not made public.

"Spain has not changed its position. From the beginning, the top priority of our strategy has been to attract companies that can design or produce microchips, and part of the value chain," a statement from the prime minister's press office said.

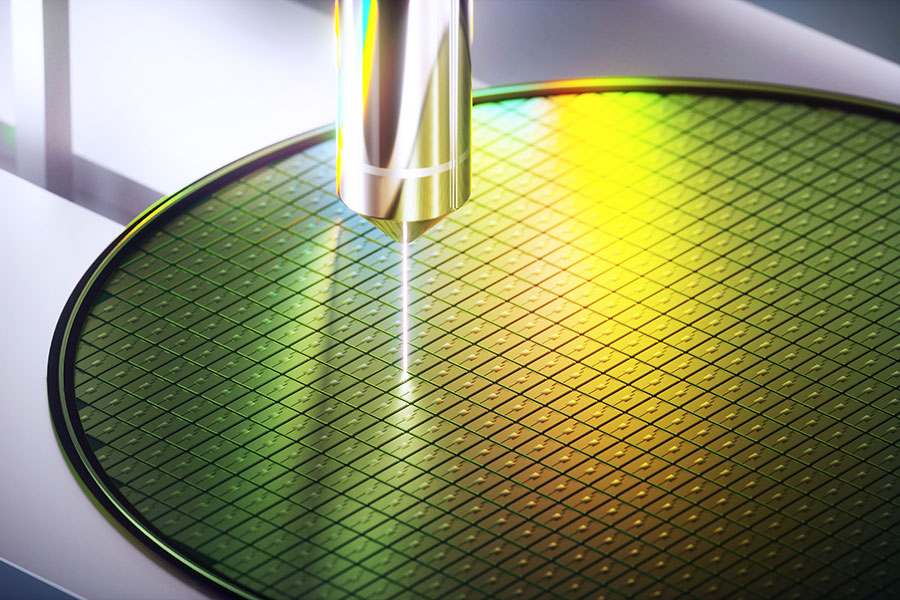

Spain has now scaled back its desire to produce the most technologically advanced chips and is adjusting its plans to take advantage of growing global demand for 10- to 28-nanometer chips that could supply Spain's automotive industry.

When Spain first announced its strategic plan, funded by EU recovery funds, more than half of the budget was earmarked to subsidize chips smaller than 5nm. These top-of-the-line semiconductors will require facilities costing tens of billions of dollars to develop.

Even before the plan was officially announced, Spanish officials considered changing their strategy after U.S. tech giant Intel Corp. chose Germany to build a 17 billion euro European complex in March, according to people familiar with the matter. Then, a major U.S. manufacturer pulled out of advanced negotiations for an investment deal in Spain after the Biden administration announced $50 billion in subsidies for chipmakers.

"We will subsidize chip manufacturing in Spain, which may be thinner or more mature, based on innovation and in line with the EU chip bill," the press office statement said. "We have a clear strategy, but we will adjust as the market evolves."

This coincides with a shift in European policy, after the European Commission earlier this year proposed a Chip Bill that would allow subsidies for the production of "first-of-a-kind" semiconductors.

Countries with large automotive industries, including France, have pushed to subsidize the less advanced chips needed for car production, arguing that if the EU wants to achieve its 20 percent target, it can't just focus on cutting-edge chips.

EU countries last week adopted their own version of the chip bill, and slightly expanded the scope of subsidies.

source:aijiwei

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'