Smartphone shipments from original design manufacturers/independent design houses (ODMs/IDHs) declined by 5% year-on-year (YoY) in 2022, according to Counterpoint Technology Market Research’s latest Global Smartphone ODM Tracker and Report.

According to Senior Research Analyst Shenghao Bai, the YoY decline in ODM/IDH companies’ shipments in 2022 was driven by weak performance from OPPO Group, Transsion Group, Lenovo Group and HONOR.

“These smartphone OEMs were hurt by economic headwinds during the year and the negative effects were passed directly to their ODM partners,” said Bai. “However, the contribution of ODMs toward smartphone shipments has been increasing. For instance, the proportion of ODM shipments in vivo rose rapidly in 2022 after the brand kicked off its cooperation with Huaqin and Longcheer.”

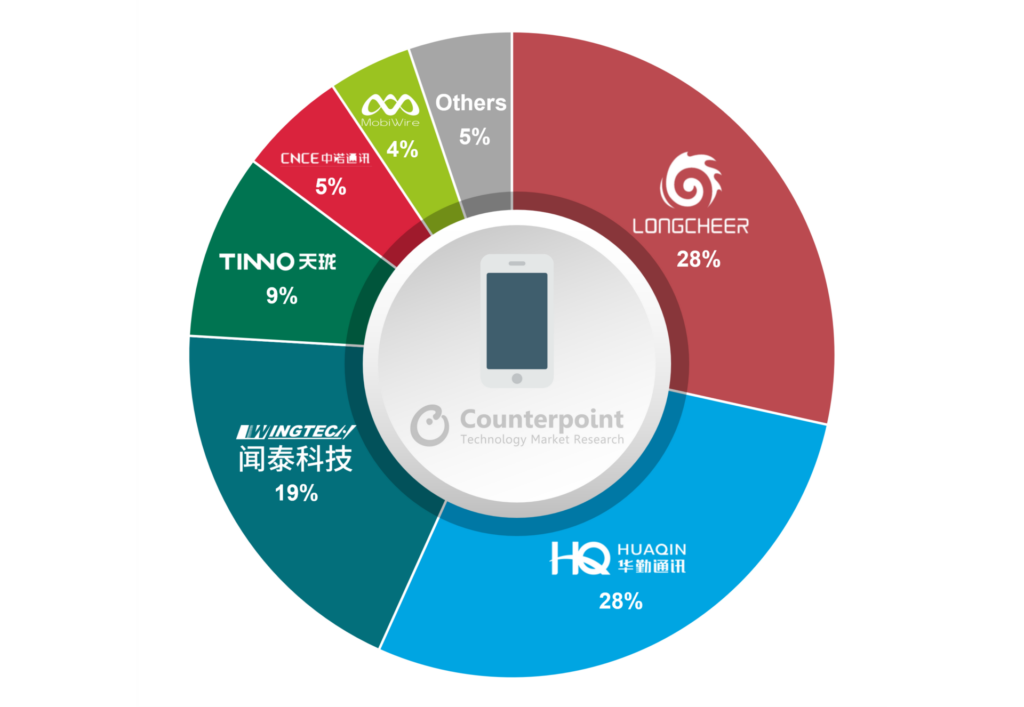

Longcheer, Huaqin and Wingtech continued to dominate the competitive landscape of the global smartphone ODM/IDH industry in 2022. The companies, also known as the ‘Big Three’, accounted for 76% of the global ODM/IDH smartphone market in 2022 compared with 70% in 2021.

Global Smartphone ODM/IDH Vendors Shipment Share, 2022

Source: Counterpoint Research’s Global Smartphone ODM/IDH Tracker, 2022

“Longcheer’s shipments surged in 2022 due to strong orders from Xiaomi and Samsung, helping the company rank first in terms of shipment share. Meanwhile, Huaqin managed to remain one of the leaders among ODMs due to its diversified client portfolio and an increase in orders from vivo, the top smartphone OEM in China. In contrast, Wingtech saw only a modest YoY increase in shipments, as it continues to view smartphone ODMs as only one component of its overall ODM business,” Senior Research Analyst Ivan Lam said. “In Tier 2, Tinno’s shipments continued to grow steadily after the spin-off of the WIKO brand, due to successful marketing with major carriers in the US, Japan and Africa. Its partnerships with Lenovo and Transsion also contributed to an increase in shipments. MobiWire experienced a significant rise in shipments after winning Transsion’s projects. Additionally, its recent collaboration with TCL is expected to serve as an alternative revenue source as TCL shifts its focus to the below $300 segment.”

“The leading ODM players are actively expanding their ODM and EMS services to other smart device categories, with Huaqin ranking first in shipments in broader smart devices categories. To enrich their portfolios, ODMs are actively exploring sectors such as components, semiconductors, automotive and XR products. They are trying to put more helmsmen in place to ensure their company sails more steadily in the face of global headwinds,” Lam said.

China’s manufacturing sector has been recovering after COVID-19 restrictions in the country were lifted. China’s capacity is expected to return to normal by 2023. Meanwhile, the global electronic industry’s manufacturing diversification continues to grow.

Bai said, “Smartphone OEMs are investing heavily in India. Meanwhile, EMS companies are expanding their assembly lines to India, Southeast Asia, LATAM and other regions. India’s local manufacturing will be able to fulfill the domestic demand and will also be sufficient for exports.”

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'