TrendForce reports that May proved to be a turning point in the lithium salt market, highlighting a notable surge in prices. The price of battery-grade lithium carbonate and lithium hydroxide in China skyrocketed from less than CNY 200,000/ton (~USD 28,000) to over CNY 300,000/ton (~USD 43,000). Notably, the ASP of battery-grade lithium carbonate surged by more than 28%, hitting CNY 254,300/ton. In contrast, battery-grade lithium hydroxide, while slower to respond, saw a 4% drop, with its ASP at approximately CNY 254,900/ton in May. Interestingly, the price differential between these two types of lithium salts has now been significantly reduced.

Despite the sharp increase in lithium salt prices boosting battery cell costs, this hike hasn’t yet translated into an immediate rise in li-ion battery prices. Alongside this, the prices of other crucial li-ion battery materials, such as cathode precursor materials, anode materials, separators, electrolytes, and PVDF, continue to trend downwards. This combination of factors has led to a continued decline in li-ion battery prices throughout May.

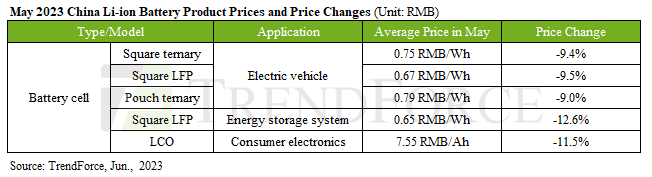

May saw a 9% price drop in EV square ternary cells, LFP cells, and pouch ternary power cells, settling at CNY 0.75/Wh, CNY 0.67/Wh, and CNY 0.79/Wh, respectively, as EV markets gradually regained their footing. In the energy storage cell market, prices dropped by a significant 12.6% to CNY 0.65/Wh, with demand in the LFP storage cell market rebounding well, particularly due to the noticeable increase in orders from leading companies. In the consumer battery cell market, prices fell by 11.5%, with LCO cells pried at CNY 7.55/Ah. However, with consumer markets picking up and an expected surge in e-commerce sales in June owing to the 618 shopping day festival, LCO cells are likely to see a price rebound.

TrendForce posits that after a strong rebound in lithium salt prices in mid-May, the market started to stabilize towards the end of the month. While the Chinese EV battery market was slowly recuperating in May, the surge in lithium salt prices partly stemmed from the suppliers’ reluctance to lower prices. Another contributing factor was the increased demand from downstream battery manufacturers looking to replenish their stocks in anticipation of a price rebound.

TrendForce asserts that the Chinese EV battery industry is currently on a recovery path. In May, lithium salt prices began surging dramatically—at its peak rising by CNY 10,000/ton per day. Multiple factors contributed to this irrational price increase, which is not a result of a rapid surge in actual demand, but a steady recovery. June is expected to be a period of peak market demand. However, it’s important to monitor changes in actual downstream demand to prevent dramatic fluctuations in lithium salt prices due to market expectation psychology, which could potentially worsen market conditions.

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'