Sensors for electrification and ADAS are showing remarkably strong growth between 2019 and 2029, with 24% and 17% CAGR, respectively, reports Yole Developpement.

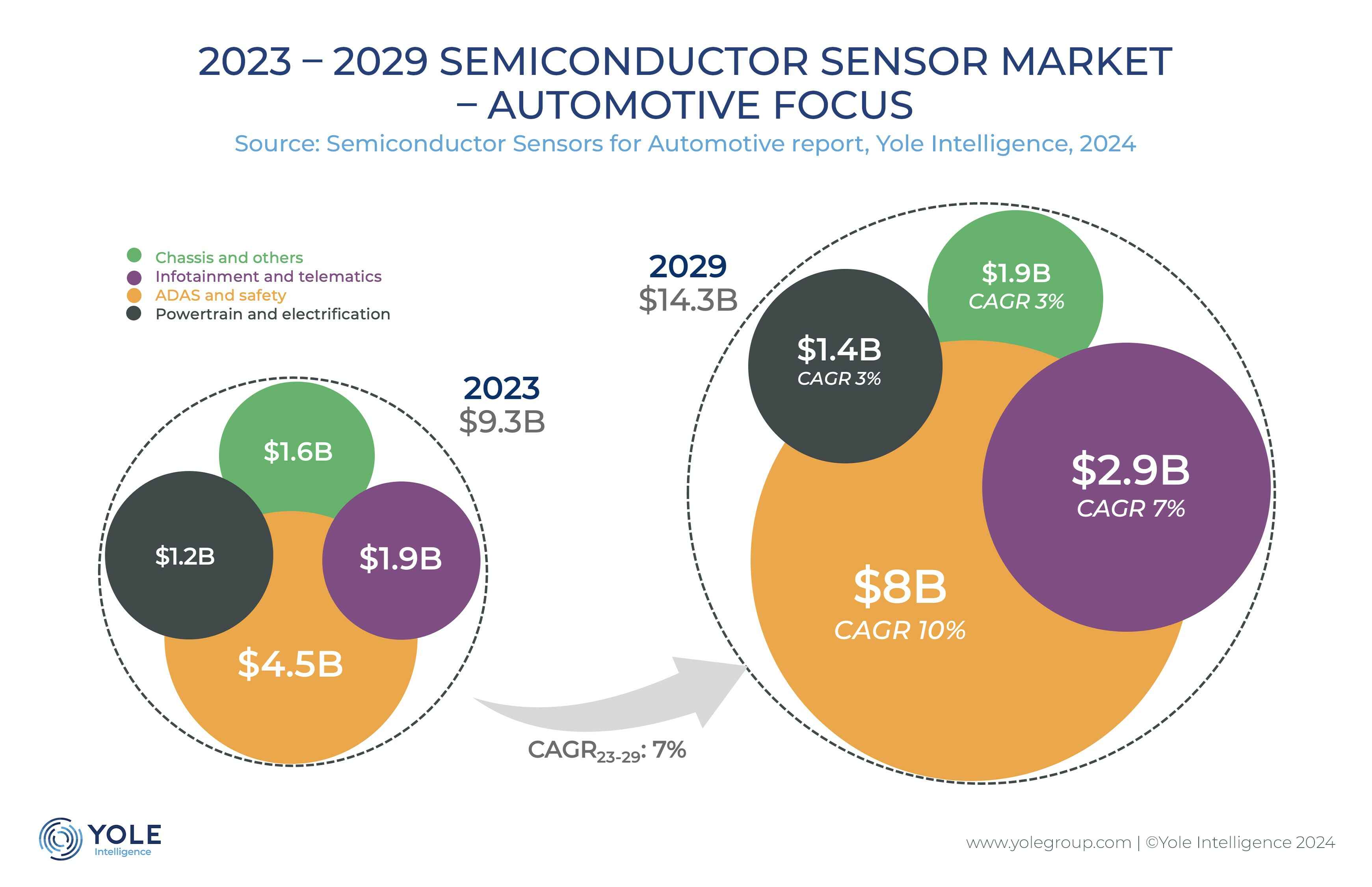

6.5 billion semiconductor sensors for automotive applications were shipped last year generating revenue of $9.3 billion and demand is pointing to a 9 billion unit market with revenue of $14.3 billion by 2029 at a 7% CAGR between 2023 and 2029.

“The upcoming years are poised to witness a dynamic transformation in automotive sensor technology driven by advancements in ADAS, autonomous driving, electrification, and the widespread adoption of sensors across global car fleets,” says Yole’s Pierrick Boulay, “consequently, substantial reorganization within the industry and its supply chain is anticipated.”

The biggest segments are radars and CIS, with more than $4 billion and more than $3 billion, respectively, in 2029. LiDARs will have the biggest growth at 48% to $649 million during the 2019-29 period.

Bosch, leads the market due to strong revenue in MEMS (pressure, accelerometer, IMU) and radar.

During these coming years, the automotive industry is expected to go through massive transformations in all four car domains:

In powertrain and electrification, the automotive industry is transitioning from cars based on internal combustion engines (ICE) to electrified cars, which are expected to represent 43% of production in 2029.

In terms of sensors, this segment will grow with a 3% CAGR between 2023 and 2029. In the long term, the electrification of cars will induce critical changes in the sensor landscape by giving birth to new applications while removing others.

In the ADAS and safety segment, cars are becoming more intelligent, enhancing safety while driving autonomously. Revenue is by far the largest of all segments and Yole forecasts about $8 billion in revenue by 2029.

Infotainment and telematics: with customers demanding greater entertainment options for both drivers and passengers, this sector is projected to achieve a favorable 7% CAGR from 2023 to 2029. This segment should exceed $2.9 billion by 2029.

In the chassis domain, OEMs strive to improve passenger safety, send valuable data to the ADAS computing unit, and even remove hydraulic systems in the car. In this context, the global sensorization of cars is driving sensor volumes to a 3% CAGR between 2023 and 2029. In terms of revenue, Yole Group expects almost $1.9 billion to be generated in 2029.

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'